.jpg)

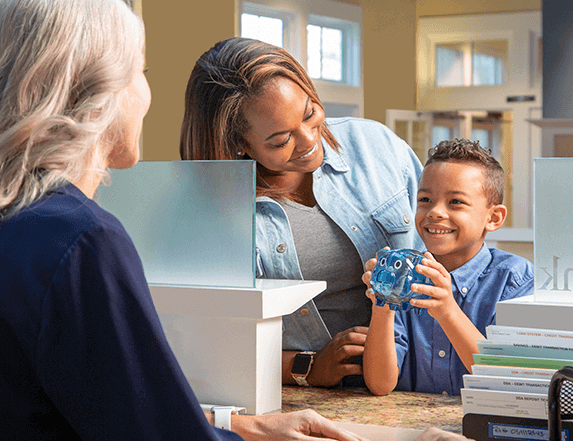

Our biggest reward is helping you, but this is nice too.

We're proud to announce we've been ranked Best Retail Bank for Customer Satisfaction in the Southeast Region, including #1 in Trust and #1 in People.

Open an AccountChoose Log In

What can we help you find?

Your United Community Experience Starts Here

At United Community, we believe in providing you with the personal banking services that you really need. From checking and mobile banking to savings, credit cards and loans, we’ve got you covered.

With a United account, you’re not just getting award-winning solutions. You get personalized services, a banker that’s just a phone call away, and an entire team that’s dedicated to your success.

We're celebrating 75 years!

It’s been 75 years since we opened our doors as Union County Bank in Blairsville, Georgia. Life looks a little different now, but our commitment to you and your financial success will always be the same. Thank you for making 75 years possible—we’re looking forward to many more!

Making an Impact in Our Local Communities

Financial Literacy Workshop | Marietta, GA

Bridgette Reynolds, Senior Customer Service Representative in Marietta, GA, participated in a Financial Literacy Workshop, presenting a donation to Girls Inc. of Greater Atlanta. She shared insights on her role at United Community Bank and discussed financial topics like saving, mortgages, and investing with the girls.

Habitat for Humanity | Wake County, NC

United team members in Wake County, NC, volunteered in a Habitat for Humanity build, supporting affordable homeownership in their community. This effort reflects the United Community Bank Foundation’s commitment to investing in communities and helping families achieve their housing goals.

Honoring Local Veterans | Greenville, SC

Looking for more information?

Bank Anytime, Anywhere with the United App

Get complete control of your banking experience with the United Community mobile app. You can view and manage your accounts, turn your debit card off, and more, all from the palm of your hand.

- For J.D. Power 2025 award information, visit jdpower.com/awards